when are property taxes due in williamson county illinois

A USPS postmark date of 22822 will be accepted as proof of timely payment. May 3 Co Clerk Extends Taxes.

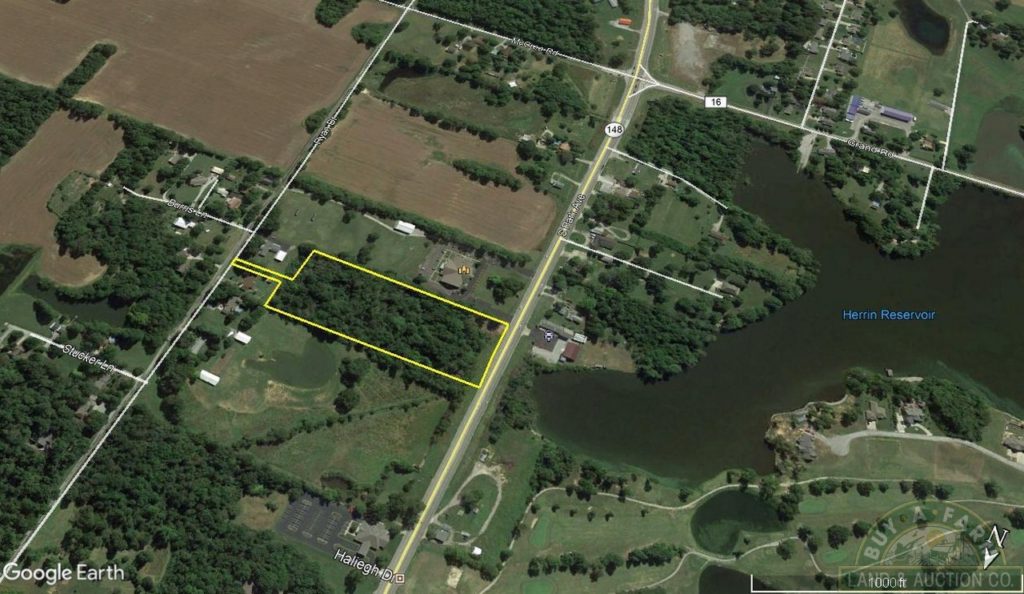

59 Acres Williamson County Il Farmland Farm Tillable Barn Timber 2400l Buy A Farm Land And Auction Company

March 7 Sent off final abstract.

. You may pay your property taxes at most Williamson County Banks. The Williamson Central Appraisal District is a separate local agency and is not part of Williamson County Government or the Williamson County Tax Assessors Office. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Make sure you have your parcel number. According to Illinois State Statute the County Treasurer must hold an annual tax sale to sell unpaid property taxes.

138 of home value. Illinois homeowners again paid the nations second-highest property taxes behind New Jersey in the annual survey by WalletHub. Yearly median tax in Williamson County.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. The County Treasurer conducts a sale of the unpaid taxes every year for the property in delinquency. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

In most counties property taxes are paid in two installments usually June 1 and September 1. The median property tax on a 8760000 house is 151548 in Illinois. Taxes 2022 Williamson TN 2022 Williamson TN.

American Express Visa MasterCard and Discover credit cards see Convenience Fee Schedule below An added fee. July 12 Sept 1215 Penalty on 1st Installment. Property owners who have their taxes escrowed by their lender may view their billing information using our Search My Property program.

The median property tax on a 8760000 house is 120888 in Williamson County. If taxes are paid through escrow Mortgage Company Savings and Loan Bank it is your responsibility to forward the property tax bill to your agent. Payment can be made by.

Williamson County collects on average 138 of a propertys assessed fair market value as property tax. Pay Property Taxes Online in Williamson County Illinois using this service. If you have sold real estate mail the property tax bill to the new owner.

The median property tax on a 8760000 house is 91980 in the United States. Williamson County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Williamson County Illinois. Currently in Illinois properties are assessed at 13 or 33 of their market value with the exception of Cook CountyAlso an equalization factor or.

Welcome to Property Taxes and Fees. Online payments will be available again starting approximately May 31 2020 and ending November 27 2020 at 400 pm. Professional tax buyers and private citizens bid on the right to buy the delinquent taxes on individual parcels of property.

Reserve Forces and have received an honorable discharge. SEARCH PROPERTY DATA HERE Personal Property Schedule B due March 1st click link for form Responsibilities Services The Williamson County Assessor of Property is a Tennessee constitutionally elected official who serves at the pleasure of the Williamson County citizens for a four-year term of office. Mail received after the due date and without a valid postmark cannot be accepted as proof of on-time payment.

Call the Williamson County Clerk at 618-998-2110 and ask for an Estimate of Redemption. Be a Williamson County Illinois resident and have served in the United States Armed Forces The Illinois National Guard or US. Please remember that the county is not selling the property at the sale but rather the unpaid.

July 11 1st Installment Due. September 13 September 25 400 pm. The median property tax in Williamson County Illinois is 1213 per year for a home worth the median value of 87600.

2021 property taxes must be paid in full on or before Monday January 31 2022 to avoid penalty and interest. If the taxes on a parcel of land mineral rights or mobile home are not paid they become delinquent. 3 penalty on 1st Installment 15 penalty on 2nd Installment.

2021 Property tax statements will be mailed the week of October 18th. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes. 2021 Williamson County property taxes are due by February 28 2022.

September 12 2nd Installment Due. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. THE APPLICATION DEADLINE FOR 2021 is April 5 th 2022.

2021 Property Tax Information. Illinois taxes average 4705 on a 205000 house the national. Illinois is ranked 1156th of the 3143 counties in the United States in order of the.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. These records can include Williamson County property tax assessments and assessment challenges appraisals and income taxes. May 28 Mail Tax Bills.

A disabled veteran with at least a 70 service-connected disability will receive a 5000 reduction in the propertys EAV. The Williamson Central Appraisal District is located at 625 FM 1460 Georgetown TX 78626 and the contact number is. Online Payments Online payments are only available during a portion of the tax collection period.

The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. Assessed value is the foundation upon which taxing authorities determine the amount of real estate taxes to be paid. 2018 - 2019 Real Estate Tax Collection Schedule.

History Williamson County Illinois

Williamson County Illinois Home County Seat Of Williamson County

Online Real Estate Auction Williamson County Il 133 Acres 1 Tract 2683a Buy A Farm Land And Auction Company

Williamson County Il New Home Builders Communities Realtor Com

Online Auction Williamson County Il 523 Acres Hunting Deer Turkey Waterfowl Lakes Ponds 2778a Buy A Farm Land And Auction Company

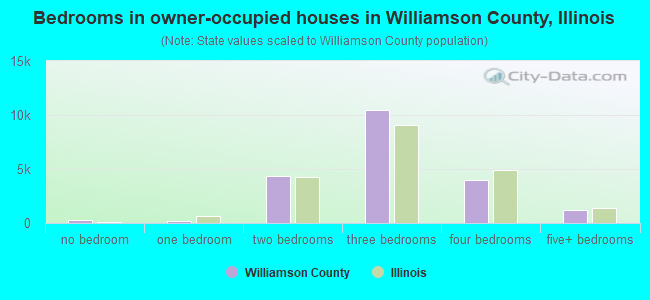

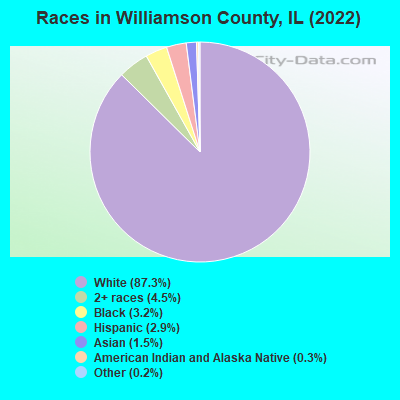

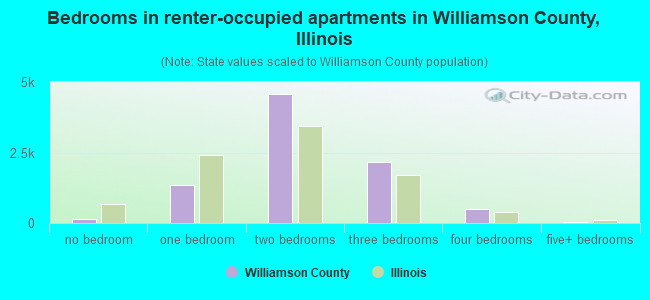

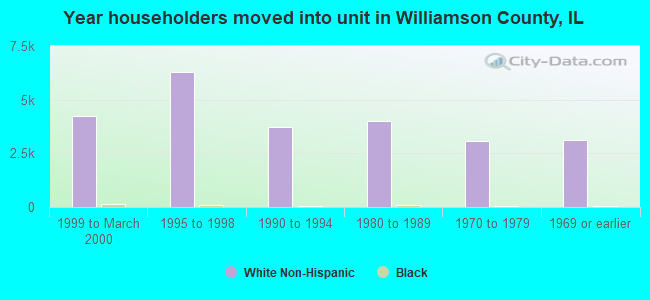

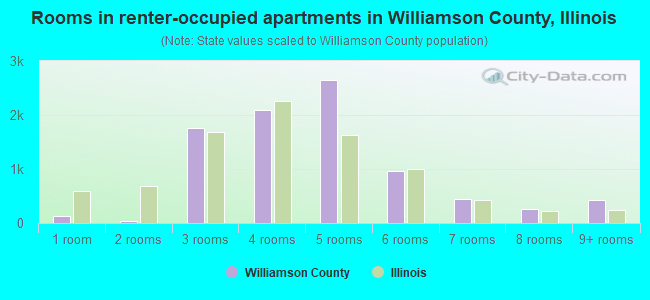

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

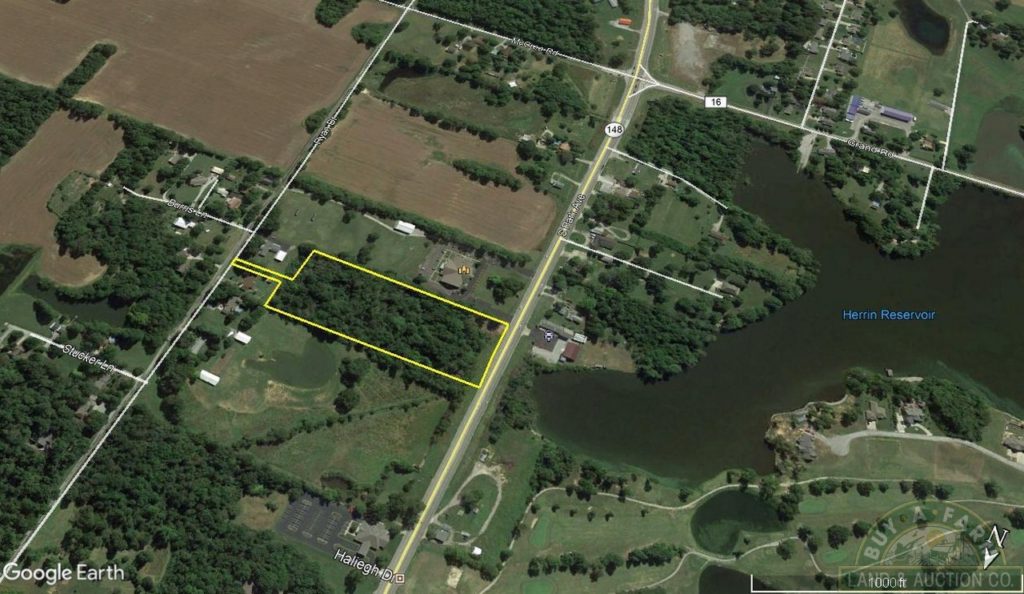

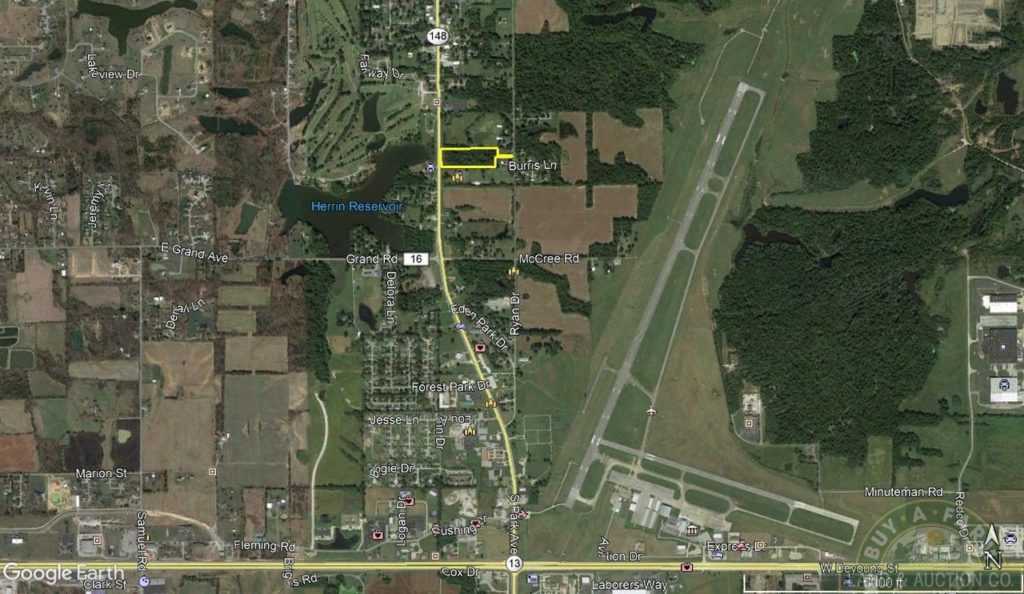

Online Land Auction Williamson County Il 9 Acres Wooded Home Building Site 1 Tract 2717a Buy A Farm Land And Auction Company

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Online Land Auction Williamson County Il 9 Acres Wooded Home Building Site 1 Tract 2717a Buy A Farm Land And Auction Company

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Online Land Auction Williamson County Il 9 Acres Wooded Home Building Site 1 Tract 2717a Buy A Farm Land And Auction Company

For Sale 240 Acres Williamson County Il Hunting Recreation Wooded Tillable Ponds 2292l Buy A Farm Land And Auction Company

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Williamson County Illinois Home County Seat Of Williamson County

View Pay Property Taxes Williamson County Illinois

Bost Orchard Rd Creal Springs Il 62922 Realtor Com

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

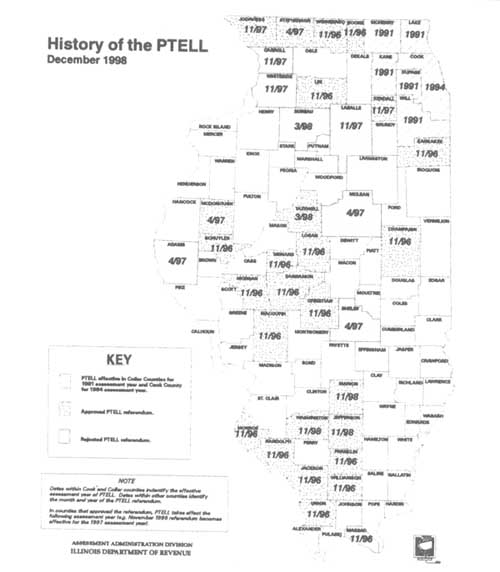

Surviving Property Tax Caps In Illinois Public Libraries

81 Acres West Frankfort Il Property Id 8977807 Land And Farm